The FTC’s “Click-to-Cancel” Rule for Subscriptions

Table of Contents The FTC’s New “Click-to-Cancel” Rule One chargeback caused havoc that a smooth cancellation could have prevented. Consider the story of Lisa,

Table of Contents The FTC’s New “Click-to-Cancel” Rule One chargeback caused havoc that a smooth cancellation could have prevented. Consider the story of Lisa,

Table of Contents Secure and Efficient Payment Processing for Travel Agencies For travel agencies, managing payments is just as important as crafting the perfect

Table of Contents Streamline Client Payments with Reliable Payment Processing for Accounting and Tax Services As an accounting or tax service provider, you’re focused

Table of Contents Drive Growth with Reliable Payment Processing for Auto Parts Stores Running an auto parts store means juggling inventory, assisting customers, managing

Table of Contents Powering the Future of E-Commerce: Why Online Electronics Stores Need Reliable Merchant Services Running an online electronics store brings unique opportunities

Table of Contents The Innovation Behind Dropshipping: Empowering Entrepreneurs to Succeed Dropshipping has revolutionized the way businesses operate, especially for entrepreneurs looking to minimize

Table of Contents How Durango Merchant Services Helps Nootropic Companies with Credit Card Processing Imagine you’ve spent years researching, formulating, and perfecting your line of

Table of Contents Understanding Credit Card Processing for Hotels When it comes to credit card processing for hotels, the needs of the hospitality industry

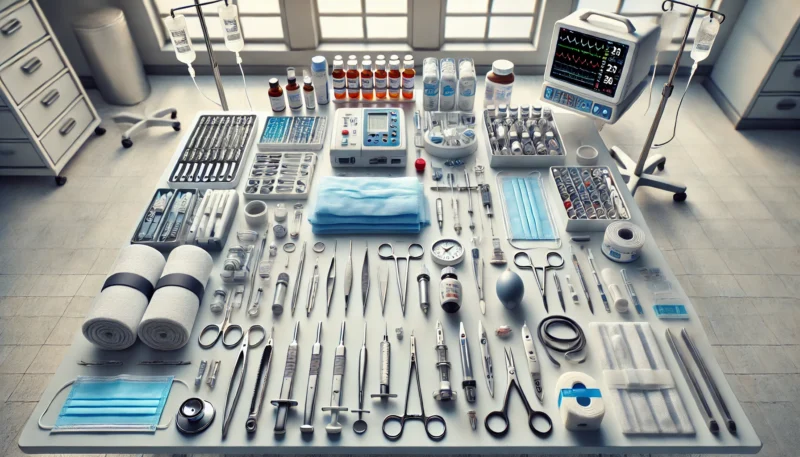

Table of Contents Understanding Merchant Services for Medical Device and Supply Companies Medical device and supply companies have unique needs when it comes to

Table of Contents Understanding Merchant Accounts for Immigration Services Firms Immigration services firms play a vital role in helping individuals and families navigate complex legal

10 Town Plaza Ste 162

Durango, CO 81301